NSE: Rupa

NSE of India Limited is the primary stock exchange in India, headquartered in Mumbai. Many financial institutions, including banks and insurance companies, remain owned by NSE. It is the world’s leading derivatives exchange by the number of contracts traded [a] and the third largest in cash shares by the number of trades[b] by 2022. It is one of the world’s largest stock exchanges by market capitalization. NSE’s flagship index, the NIFTY 50, a stock index of 50, is widely used by investors in India.

Table of Contents

What is Rupa Company?

Rupa & Company Limited is an Indian textile company founded in 1968. The Company remains headquartered in Kolkata, West Bengal. It manufactures a range of innerwear, casual wear, and thermal wear for men, women, and children under various brand names, such as Rupa, Frontline, Euro, Bumchums, Torrido, and Thermocot.

Rupa & Company has a strong presence in India and exports its products to several countries, including the United States, the United Kingdom, Canada, Australia, and the Middle East. The Company has a large manufacturing facility in Uttar Pradesh and over 20,000 retail outlets across India.

In addition to textiles, Rupa & Company has diversified into other business areas such as real estate, retail, and education. The Company remains listed on the Bombay Stock Exchange and the National Stock Exchange of India.

What are the uses of Rupa Company?

Rupa & Company is primarily involved in the manufacturing and selling of textiles, particularly innerwear, casual wear, and thermal wear. The Company has a diverse range of products that cater to men, women, and children. Some of the uses of Rupa & Company’s products are:

Innerwear: Rupa & Company manufactures a wide range of underwear, vests, and briefs for men, women, and children. These products remain designed to provide comfort and support and are essential to everyday clothing.

Casual Wear: Rupa & Company also produces casual wear such as t-shirts, tops, leggings, and shorts for men, women, and children. These products are designed for everyday wear and are comfortable and stylish.

Thermal Wear: Rupa & Company’s Thermocot range of thermal wear remain designed to provide warmth in cold weather conditions. The range includes thermal tops, leggings, and sets for men, women, and children.

Export: Rupa & Company exports its products to several countries, including the United States, the United Kingdom, Canada, Australia, and the Middle East. The Company’s products remain used by consumers across the globe.

In addition to these uses, Rupa & Company has also diversified into other business areas such as real estate, retail, and education.

What is the annual income of Rupa Company?

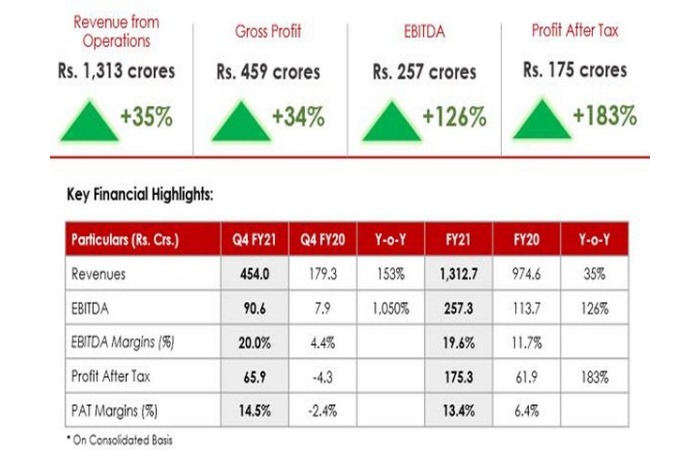

According to its financial reports for 2020-21, the Company had a consolidated revenue of INR 1,744 crores (approximately USD 235 million) and a net profit of INR 93 crores (about USD 12.5 million) for the fiscal year. It is worth noting that these figures are subject to change based on various factors such as market conditions, economic trends, and company performance.

What is the financial condition of Rupa Company?

Based on the Company’s financial reports and performance in recent years, we can make some observations about its financial situation:

- Revenue Growth: Rupa & Company has shown steady revenue growth over the past few years, driven by its diversified product portfolio and strong brand recognition. The Company’s revenue increased from INR 1,472 crores in 2019-20 to INR 1,744 crores in 2020-21.

- Profitability: Rupa & Company has maintained a stable level of profitability over the years. The Company’s net profit for 2020-21 was INR 93 crores. Which was slightly lower than the previous year due to the impact of the COVID-19 pandemic on the business.

- Debt Levels: Rupa & Company has a low level of debt compared to its peers in the industry. As of March 2021, the Company’s long-term debt was INR 106 crores, and its debt-to-equity ratio was 0.4.

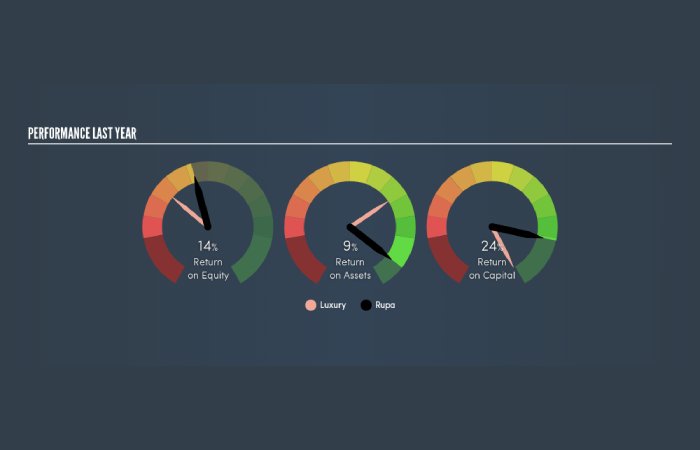

- Investments: Rupa & Company has strategically invested in technology, marketing, and product innovation to strengthen its position in the market. The Company has also diversified into other business areas. Such as real estate, retail, and education, which could provide additional revenue streams in the future.

Overall, based on the available information, Rupa & Company’s financial condition appears to be stable and growing, with a focus on strategic investments and product diversification. However, it is important to note that this information is subject to change. Based on market conditions, economic trends, and company performance.

Is it reasonable to invest in Rupa Company?

I can provide some general information to help you make an informed decision.

Investing in any company involves risks, and conducting thorough research and analysis is important before making any investment decisions. Some factors to consider when evaluating Rupa & Company as a potential investment opportunity could include the following:

- Industry Trends: It is important to evaluate the overall trends and dynamics of the textile industry, including consumer demand, competition, and market conditions, to understand the potential growth prospects of Rupa & Company.

- Financial Performance: It is important to evaluate the financial performance of Rupa & Company, including its revenue, profitability, debt levels, and cash flow, to understand the Company’s financial stability and growth potential.

- Product Portfolio: It is essential to evaluate the diversity and competitiveness of Rupa & Company’s product portfolio, including its brand recognition, quality, and innovation, to understand the Company’s ability to compete in the market.

- Management: It is essential to evaluate the quality and experience of Rupa & Company’s management team, including their strategic vision, operational capabilities, and track record of success.

Based on these factors and other relevant information, you can make an informed decision on whether or not to invest in Rupa & Company. However, it is essential to note that any investment carries risk. You should consult a financial advisor or research before making investment decisions.

What is the NSE: Rupa?

NSE: Rupa refers to the stock symbol or code used to identify Rupa & Company Limited’s shares on the National Stock Exchange of India (NSE). Rupa & Company remains publicly traded; its shares remain listed on the NSE and the Bombay Stock Exchange (BSE). Investors can buy or sell Rupa & Company’s shares using the NSE: Rupa stock code through their brokerage accounts. The stock price of Rupa & Company may fluctuate based on factors such as market conditions, economic trends, company performance, and investor sentiment.

FAQS of NSE: Rupa

Here are some frequently asked questions (FAQs) related to NSE: Rupa:

What is NSE: Rupa?

Ans: NSE: Rupa is the stock code or symbol used to identify the shares of Rupa & Company Limited on the National Stock Exchange of India (NSE).

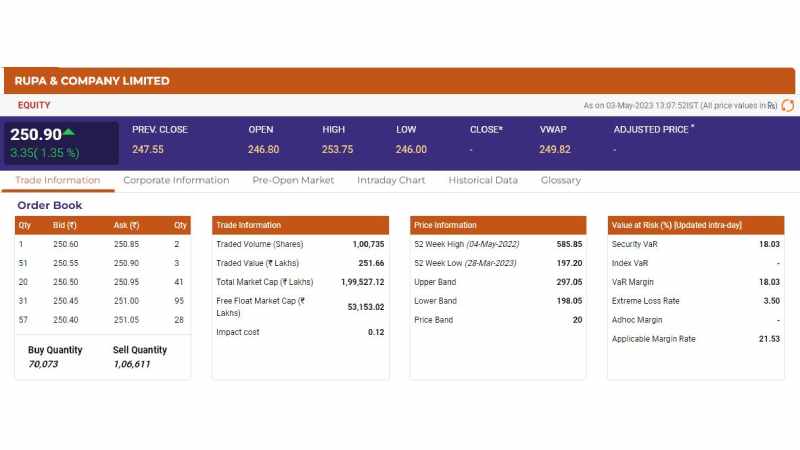

What is the current price of NSE: Rupa?

Ans: The current price of NSE: Rupa can remain found on various financial websites. And stock market apps, and brokerage platforms that offer real-time market data

How can I buy shares of Rupa & Company Limited?

Ans: To buy Rupa & Company Limited shares, you must have a brokerage account with a registered stockbroker. You can place an order to buy the shares using the NSE: Rupa stock code through your brokerage account.

What are the factors that affect the stock price of Rupa & Company Limited?

Ans: The stock price of Rupa & Company Limited can be affected by various factors such as market conditions, economic trends, company performance, financial results, news announcements, and investor sentiment.

What is the market capitalization of Rupa & Company Limited?

Ans: Market capitalization is the total value of a company’s outstanding shares. As of my knowledge cut-off date (September 2021), the market capitalization of Rupa & Company Limited was approximately INR 2,400 crores (USD 325 million). However, this information may have changed since then.

What is the dividend policy of Rupa & Company Limited?

Ans: Rupa & Company Limited has a consistent history of paying dividends to its shareholders. The board of directors decides the Company’s dividend policy based on various factors. Such as financial performance, capital requirements, and cash flow.